renewable term life insurance policy can be renewed

Most companies only offer their policies to be renewed up to age 90. Term Life Insurance.

Also called yearly renewable term it guarantees coverage for one year and can be renewed annually at a higher premium or converted to a permanent life insurance policy.

. For example your plan must be guaranteed renewable. While short-term medical insurance is much more limited than a typical health insurance policy the best short-term health insurance policies serve as a temporary stop-gap between plans provided. Generally your insurance company will establish your premiums or the fees you pay for the length of the term.

Mutual of Omaha also offers three universal life options one of which has a 2 guaranteed interest rate on the cash value. Non-cancelable policies will continue at the same price and coverage as long as you pay your premiums on time. Banner provides the option to renew their term life to age 95.

Yearly renewable term insurance for a person aged 45 ten year term insurance for a. How To Choose The Right Health Insurance. 1 to 3 as new Subparas.

Ten year term insurance for a person aged 45 c. With this flexible plan you can keep your coverage as long as you feel is necessary by renewing your policy annually. However to get the most out of a short term health plan you need to understand how they work what they cost and what they cover.

SBI Life Smart Champ Insurance. Your premiums may increase when you renew the policy. Short term health insurance is a type of health plan that can provide you with temporary medical coverage when you are between health plans outside enrollment periods and need some coverage in case of an emergency.

For example premiums would increase every five years on a five-year renewable policy. The Sum Insured under the floater policy can be used to meet hospitalization or other permitted expenses for any of the insured members under the policy. It can be anyone from your spouse children to your parents.

OPTerm Life Insurance. Beneficiary The person that youve nominated to receive your insurance pay-out in the event of your death. Smart Benefits as per policy-SBI Life Smart Scholar.

You can see the rest of the rules here. Ten year term insurance for a person aged 55 b. United Healthcares short-term insurance plans are underwritten by Golden Rule Insurance Company a United Healthcare Company which has been offering short-term insurance for over 30 years.

Life Step UL Universal Life Insurance. Yearly renewable term insurance for a person aged 55 d. A level term life policy that lasts for one year.

A and B as clauses i and ii added provision re Public Utilities Regulatory. The government has rules about long-term care insurance plans and which ones are qualified. There are many Life Insurance Companies like LIFE INSURANCE CORPORATION OF INDIA BAJAJ ALLIANZ LIFE INSURANCE COMPANY ICICI PRUDENTIAL LIFE INSURANCE COMPANY HDFC STANDARD LIFE.

This means your policy must remain in force as long as premiums are paid. Or at renewal time prior to your age 70 you can convert your coverage to any permanent plan. A William Penn Association Yearly Renewable Term Plan offers you a low-cost plan of insurance protection when your familys needs may be the greatest.

Guaranteed renewable means the policy will be renewed automatically but the premium may increase. Banner is a great option compared to the competition. Some term policies can be renewed.

Usually this is purchased as a supplement to existing insurance for temporary needs. Issue ages for the term life policy are 18 to 80 years old on 10- 15- 20- and 30-year terms. Bajaj Allianz Health Guard Family Floater Plan.

Once that period or term is up it is up to the policy owner. Premium This is the. Conditionally renewable or optionally renewable may also be terms.

Life insurance averages are based on a composite of policies offered by Policygenius from AIG Banner Brighthouse Lincoln Mutual of Omaha Pacific Life Protective Prudential SBLI and Transamerica and may vary by. Sample premiums are for male and female non-smokers with a Preferred health rating buying a 20-year term life insurance policy. Health guard is a comprehensive family floater policy from Bajaj Allianz.

However this also means your price can go up every year after the term ends. 8 to 25 years. 21 years childs entry age.

21 to 50 years. 18 to 57 years. Renewability - Most long-term disability policies come with one of two renewability provisions.

If you dont pay your premiums your insurance company may cancel your policy. Usually seen in a term-life or other life insurance policy it refers to the amount paid out by the insurer to the beneficiary if you or the person insured dies when the policy is still active. A to C redesignated existing Subparas.

Term life insurance provides protection only during the term of the policy and the policies are usually renewable at the end of the term 15 16. However there are a few particulars to consider. Banner provides a renewable and convertible term life insurance.

Renewable to age 90. You may also like to read Best term insurance plan in India 4. While life insurance provides a financial buffer to your family if you lose your life health insurance provides you and your family a cushion to ease the burden of cost in the event of a medical emergency.

When you are looking to get a good health insurance plan in India there are a few things that you need to take into account. No matter which plan you choose you should expect premiums to increase as you get. 2 re other customers added for a term ending on December 31 2039 re credit for electricity generated by customer from Class I renewable energy source or hydropower facility redesignated existing Subdivs.

A type of life insurance with a limited coverage period. When a ten year renewable term life insurance policy issued at age 45 is renewed the premium rate will be the current rate for a. The biggest advantage of.

Annual renewable term life insurance. Policies can then be renewed at the end of the term and annually up until age 95. SBI Life Insurance Policy also offers Child Plans to ensure a safe and secure future for children so that their monetary expenses are covered.

We liked them for their seemingly low premiums longer term and self-renewable plan options. Banner offers a level premium universal life.

How To Reinstate A Life Insurance Policy That You Stopped Paying Forbes Advisor

Life Insurance Overview Federal Life

Best Term Life Insurance Quotes Guide

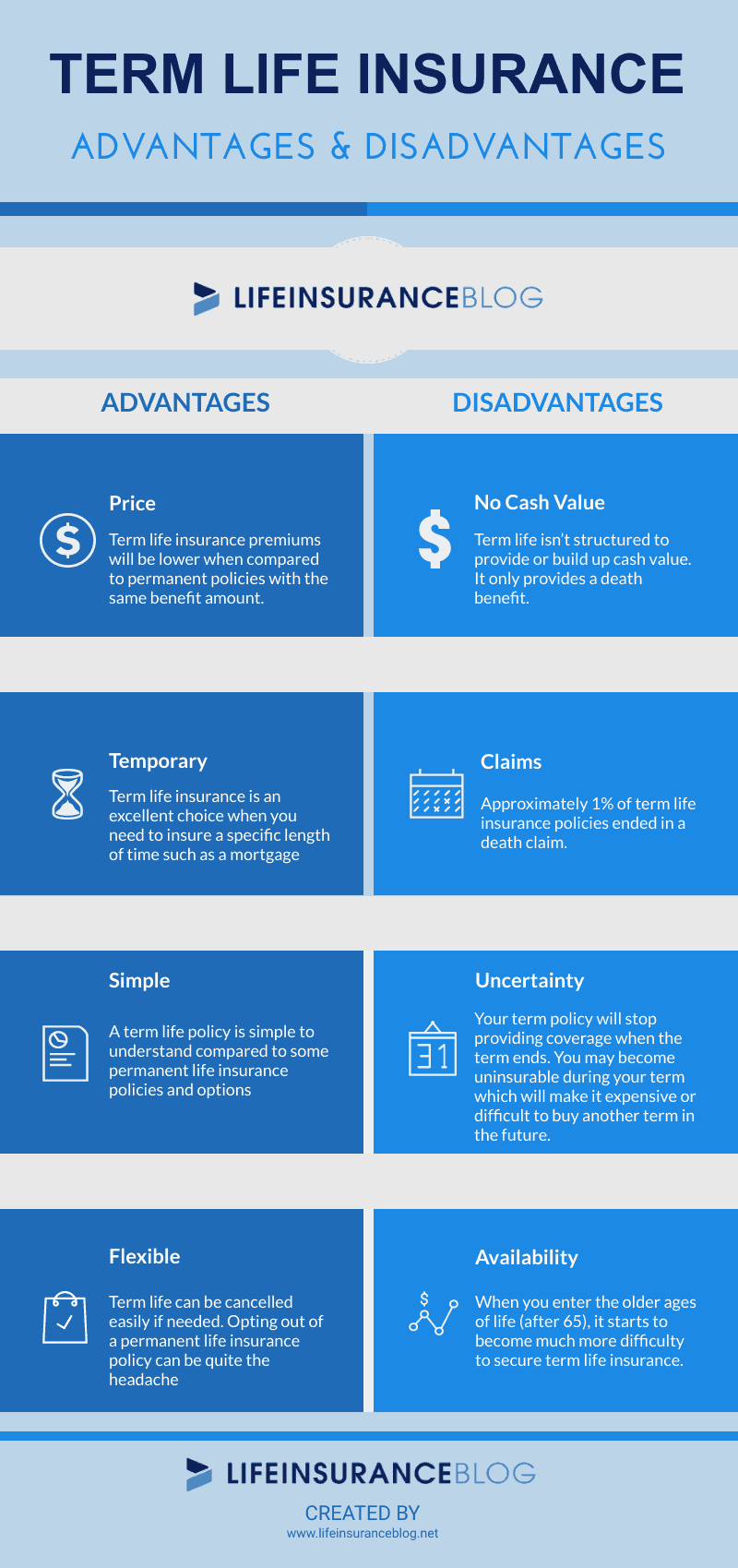

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Can My Life Insurance Company Cancel My Policy Without Notice Otterstedt

What Kind Of Life Insurance Should I Get Lincoln Heritage Life Insurance Company